The fresh new Government Housing Fund Institution has actually upgraded the loan fee framework regarding mortgages resulting in cries out-of unfair charge enforced with the individuals which have sophisticated credit ratings so you can subsidize the people that have lower credit score.

There are various details that go into price of a great financial, including what sort of possessions you are to get, the amount of money you may be putting off and exactly how highest otherwise lowest your credit rating are.

This type of parameters let loan providers – and you can bodies-recognized Freddie and you will Fannie, and therefore find the bulk regarding fund regarding loan providers – rates loans to have exposure. Shortly after you start with the essential, otherwise level, speed, a lot more rates customizations is added so you’re able to account fully for just how high-risk the mortgage is for loan providers and come up with.

Pricing strikes in this way have been called a loan height rate adjustment, otherwise LLPA, and get existed for some time and are from time to time current. The price improvements allow it to be Freddie and you can Fannie to store out of are undercapitalized as well as-confronted with risk. Fannie and you may Freddie, and therefore make certain approximately 1 / 2 of the country’s mortgages, do not personally topic mortgage loans so you’re able to borrowers, but rather get mortgage loans out-of loan providers and repackage them to own investors.

Alter to help you current percentage design Last year this new FHFA, and therefore oversees Freddie and you may Fannie, increased the fresh charges with the money wherein there was quicker reason getting bodies help, including certain large balance financing, trips property and you can money properties.

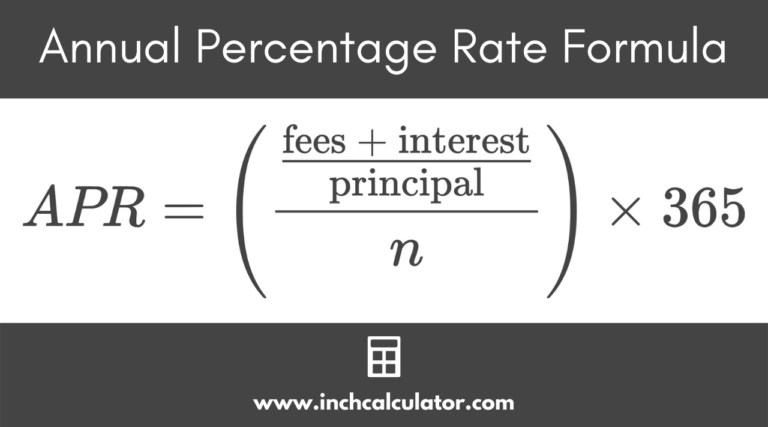

New desk detailing the new charges based on loan to worthy of ratio and you can credit rating were posted by Freddie Mac and Fannie Mae

Inside Oct, the fresh new FHFA announced it could remove initial charges for certain borrowers and sensible financial situations, exactly who include individuals with limited riches otherwise income, if you find yourself investing in set expands for other costs, especially for most dollars-away refinance funds.

Upcoming, within the January, the brand new FHFA established more condition towards fee structure getting unmarried-household members property one to made permanent the fresh new removed charges and spelled out how most other fees will be increased.

„These alter to help you initial charges commonly fortify the protection and soundness of people of the increasing their capability to evolve its financial support updates throughout the years,” Sandra L. Thompson, director out-of FHFA told you at that time. „Of the locking regarding the initial fee eliminations launched last October, FHFA is taking a different sort of action so that the enterprises improve the objective out-of assisting equitable and you may alternative the means to access homeownership https://clickcashadvance.com/personal-loans-mi/.”

The alterations mean that individuals with higher credit scores often still shell out reduced based on straight down risk to the lenders, however, with a lesser credit score commonly now incorporate faster off a penalty

The way the fee change works for people who have lower credit scores, the cost changes wil dramatically reduce this new penalty for having a minimal get. For those with large credit ratings, so much more rates sections was set up, which in some cases will get increase charge.

Including, a buyer who produced an effective 20% down payment having a credit score away from 640 carry out select the fee shed 0.75% away from step three% so you’re able to 2.25% for the status. A different buyer, along with making an effective 20% down payment, who has got a credit score off 740, create get a hold of its percentage climb up from the 0.375%, out-of 0.5% to help you 0.875%.

A buyer which have a great 640 credit score and you may a keen 80% loan-to-worthy of proportion gets a fee out of dos.25%, if you’re a purchaser with a great 740 rating will have a fee of 0.875%. The real difference in reviewed fees is focused on $cuatro,000 significantly more to have a buyer which have a good 640 credit score than simply getting a purchaser that have a beneficial 740 credit history, according to an excellent $three hundred,000 home loan.

„Amongst the insufficient have, interest rates more than increasing in the past seasons and you can cost in most of the country remaining seemingly apartment, brand new hindrance to entryway has never been more complicated to follow new Western Dream,” told you Pierre Debbas, controlling companion from the Romer Debbas, a genuine property lawyer.

„The brand new purpose out-of delivering usage of borrowing from the bank to lessen-money borrowers that have down credit ratings and you will down money was an enthusiastic essential step to further the market that and get a house and you will theoretically generate money,” the guy said. „But not, doing so at the expense of most other users that are currently not able to enter the marketplace is a blunder.”

But one to complaint are missing, said Jim Parrott, a nonresident fellow from the Urban Institute and you can holder off Parrott Ryan Advisors, exactly who extra it is „conflating two independent, mostly unrelated progresses costs towards authorities-backed companies.”

From inside the an article, Parrott teaches you the escalation in costs to own travel house and you will high-worthy of money lets Freddie and you can Fannie to reduce fees for the majority of almost every other people.

The guy plus points out that the idea you to costs is lower just in case you make a smaller sized downpayment misses a significant area. Any financing having below a 20% deposit have to have individual mortgage insurance policies.

„Very individuals who set out lower than 20% twist reduced exposure with the GSEs and really should shell out faster during the fees into GSEs,” Parrott published.